Last year the General Government debt leaped up

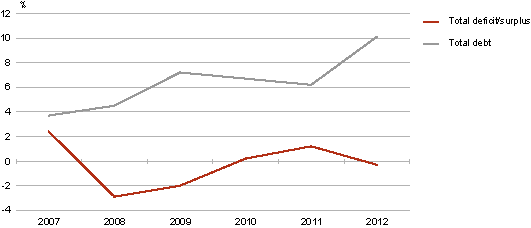

At the end of 2012, the total expenditures of the general government exceeded the revenues by 54.3 million euros, accounted as the Maastricht deficit criteria. The deficit of central government amounted to 135 million euros and in local governments’ sector, after ending in surplus in two previous years; in 2012 the expenditures amounted to 38.4 million euros more than revenues earned. The surplus of social security funds was 119.1 million euros, slightly less than in 2011 (-19%).

The level of central government’s expenditures was influenced the most by the expenses made in the account of proceeds from assigned amount units received in previous years (199 million euros) and the investments on the construction of roads: built roads worth 96 million euros were counted as state’s fixed assets in 2012.

The general government consolidated debt (Maastricht debt) rose nearly two times by the end of 2012: from 996.2 million euros to 1.7 billion euros. The lion's share of the increase resulted from the rapid growth in volume of central government’s long-term debt. Considerable role in this was played both by the loan from the European Investment Bank in amount of 385 million euros, taken for the construction of roads and co-financing the foreign projects, as well as by the involvement in the European temporary rescue mechanism, EFSF (European Financial Stability Facility). In 2012, the total liabilities towards the EFSF comprised 355 million euros, the biggest share of which (84%) constituted the participation in rescue package for Greece. In 2011, the share in EFSF, meant for the assistance of Ireland and Portugal was 13.7 million euros.

The overall debt level of local governments grew by 5% compared to the previous year. The volume of both short-term and long-term loans increased by 8.4% in total, at the same time the volume of the securities other than shares decreased by 4%. At the end of 2012, the social security funds did not contribute to the general government sector debt at all, as both the Unemployment Fund and the Health Insurance Fund did not use loanable money for financing their activities.

Surplus/deficit and debt level of the general government in Estonia, 2007–2012

Since spring 2013, the calculations of Maastricht debt and deficit levels include also the estimations of SA KredEx, as the unit is reclassified to the general government sector after the consultations with Eurostat, because the unit is acting as the non-market producer. Statistics Estonia will conduct further calculations concerning all government finance statistics by the time of publication of relevant statistics in September.

Eurostat is going to publish the data on the preliminary debt and deficit levels of the Member States on 22 April.